By Animesh Deb |

New Delhi [India], April 26 (ANI): As part of the Local for Vocal initiative, India is making a strong course correction in the toy manufacturing ecosystem. The country’s massive toy demand was till recent years met mainly through imports, largely from neighbouring China. India’s toy imports from China have reduced by an estimated 70 per cent over the recent years.

Policy interventions, such as raising import duty to discourage cheap imports, emphasis on quality and incentives have created an ambient atmosphere for the firms in this largely unorganized space.

Pushed by the self-reliant India initiative and renewed focus on enhancing domestic manufacturing post-Covid, a large number of small and big players have forayed into this area once perceived as not so lucrative proposition.

According to Invest India, a central investment promotion and facilitation agency, the domestic toy market size currently stands at an estimated value of USD 1.5 billion, and is dominated by small and medium-sized manufacturers. It says the Indian toy industry is among the fastest-growing globally, and is projected to double by 2028, growing at a CAGR of 12 per cent between 2022-28.

India is not just making toys for its own needs but is actively looking at overseas avenues. It has already expanded its global presence, with increased high-value exports to the Middle East and some African countries.

In its election manifesto for 2024, the Bhartiya Janta Party (BJP) has promised it will transform the country into the global hub for toy manufacturing, leveraging the skilled workforce and rich cultural heritage. This could be a fresh shot in the arm for the industry, which is at a nascent stage of growth.

The company ace turtle, which is licencee for Toys”R”Us in India and manages the global toy brand end-to-end here, hailed Indian government’s steps to support toy manufacturers, in particular the implementation of the National Action Plan for Toys (NAPT), which aims to promote ‘Vocal for Local’ in the toy industry.

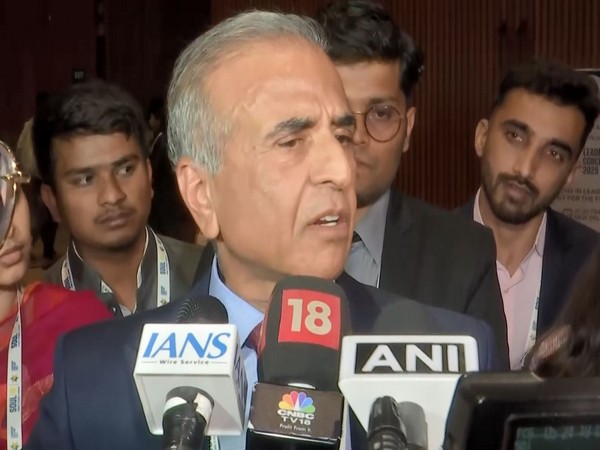

“The government has established more than 60 toy clusters across the country, with notable examples such as the 400-acre cluster set up by Aequs in Koppal, Karnataka, and the 100-acre facility under development in Uttar Pradesh. Furthermore, several states have announced incentives for toy manufacturers, subsidizing nearly 30 per cent of manufacturing costs,” said Nitin Chhabra, CEO, ace turtle – a tech-native retail company.

Toys”R”Us currently has four stores in India — Mumbai, Hyderabad, and two in Bengaluru. By the end of 2024, it plans to open eight more toy stores.

“Our long-term plan is to open 50 stores in the next three years across tier-1 and tier 2 cities,” said Chhabra.

Asked what other policy interventions may be needed, he said interventions could include setting up specialized toy manufacturing zones, providing easier access to credit for small and medium enterprises (SMEs), implementing skill development programmes tailored to the toy industry, and facilitating market entry for domestic manufacturers through trade agreements and promotional activities.

According to the ace turtle CEO, it would take about two years for the Indian toy industry to be equipped to cater to the domestic demand fully.

It is noteworthy that a sizeable portion of the market is still unorganized. It has opened floodgates for newer players to explore this space.

In what could be a case study, Jammbo, an Indian startup in the toy space founded in 2023, stormed the toy market with Rs 50 crore revenue in the first year. Highlighting the company’s growth, Manasvi Singh, CEO and Co-Founder of Jammbo, said its sucess underscores the strength of local manufacturing with global standards.

Vipin Nijhawan, Co-founder and CPO, Jammbo says, “We want to make India the toy capital of the world by 2030, we aim to elevate India’s status in the global toy market but also inspire a new generation of creators, dreamers, and innovators. With the decreasing imports from China across the world, India can match the quality and cost and become the leader in toy market.”

With over 60 lakh online sales projected in April (within the first four months of the launch of its website), the bootstrap startup has carved a niche within the ride-on battery-run toy category.

Abbas Gabajiwala, Founder and CEO at Blix Education Pvt. Ltd, which is into educational toys, asserts that the government has made non-certified toys from China very difficult to come to India.

“By introducing BIS, the government has taken the right step towards having safe toys in India that every manufacturer must comply with. This has prevented most of the substandard products from filling shelves. The government is also planning Production-linked incentive schemes for boosting the toy industry,” said Gabajiwala.

Increasingly, many kids and their parents prefer educational STEM (Science, Technology, Engineering and Math) toys so that kids can learn from them and hone their cognitive skills.

India as a country, he said, is very invested in education so most of the toys in India focus on being educational toys.

“So experimentation sets, role play toys, construction toys, board games, etc. but there’s a new trend of many companies now getting into electronics and technology-based toys that used the be dominated by China,” he further asserted.

Gabajiwala also said while the industry is growing and has huge potential, some newcomers have found the competition too stiff and have decided to close their units.

According to a case study ‘Success Story of Made in India Toys’ by Indian Institute of Management (IIM) Lucknow at the initiative of Department for Promotion of Industry and Internal Trade (DPIIT), the Indian toy industry witnessed remarkable growth in FY 2022-23 in comparison to FY 2014-15, with the decline in imports by 52 per cent, rise in exports by 239 per cent and development of overall quality of the toys available in the domestic market. (ANI)