Mumbai (Maharashtra) [India], December 15 (ANI): Participants in the Indian stock markets will closely monitor US Fed interest rate decisions, foreign fund inflows, and other global cues for the trading sessions starting from Monday, according to the experts.

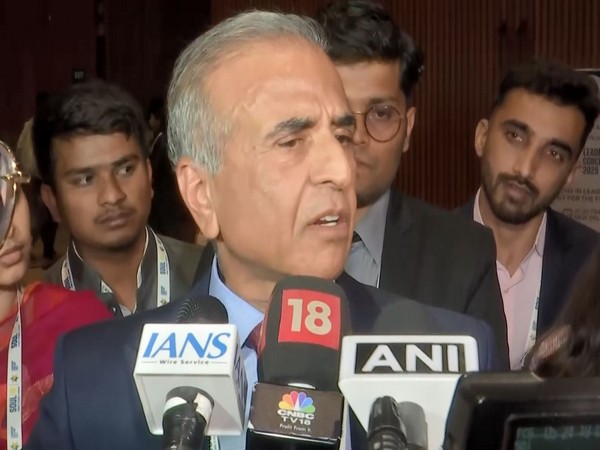

“Looking ahead to the coming week, participants will closely monitor the HSBC Composite PMI, HSBC Manufacturing PMI, and HSBC Services PMI. However, the key focus will be on the US Federal Reserve meeting, where a 25 basis point rate cut is already factored in. The Fed’s commentary on future rate policy will hold significant importance,” said Ajit Mishra – SVP, Research, Religare Broking Ltd.

Observing the market’s sentiment, Manish Goel, Founder and Managing Director, Equentis Wealth Advisory Services stated that the intention of BRICS countries to reduce the dependency on the US dollar and promote the use of local currency and India’s focus on overcoming geopolitical challenges will have an impact on the sentiments of participants.

“As BRICS seeks to lessen reliance on the dollar, India aims to strengthen trade ties and explore new opportunities for businesses, particularly in manufacturing, IT, and energy, amid changing global trade dynamics,” Goel said.

Goel further added that the markets are closely watching the December 16 data to gauge inflation trends and their effect on corporate margins, particularly in FMCG, manufacturing, and trade-exposed industries.

The markets extended their positive momentum for the fourth consecutive week, gaining nearly half a percent amid consolidation.

The benchmark indices remained in a tight range throughout most of the week but managed to close firmly on the final day despite significant volatility. Favorable macroeconomic data, including lower CPI inflation and improved Index of Industrial Production (IIP), boosted market sentiment.

However, a mixed trend in Foreign Institutional Investor (FII) activity and profit-booking in global markets capped the upside. Eventually, the Nifty and Sensex settled at 24,768.30 and 82,133.12, respectively.

On the sectoral front, a mixed trend was observed, with IT and real estate emerging as the top gainers, while energy and FMCG sectors posted marginal losses. After weeks of outperformance, the broader indices also displayed a mixed trend, with the midcap index closing in the green while the smallcap index ended slightly lower. (ANI)