Mumbai (Maharashtra) [India], June 13 (ANI): Aditya Birla-led Grasim Industries on Saturday reported a consolidated profit after tax of Rs 1,506 crore in the fourth quarter ended March (Q4 FY20), marking a growth of 32 per cent from Rs 1,144 crore in Q4 FY19.

Consolidated revenue for the quarter, however, dropped to Rs 19,902 crore from Rs 22,431 crore in the same period of previous fiscal while consolidated EBITDA (earnings before interest, tax, depreciation and amortisation) dipped to Rs 3,243 crore from Rs 3,999 crore.

Consolidated revenue and EBITDA for the FY20 stood at Rs 77,625 crore and Rs 13,846 crore respectively. Consolidated profit after tax Rs 4,425 crore recorded a growth of 161 per cent year-on-year aided by write-back of deferred tax liabilities and lower exceptional charge in the current year.

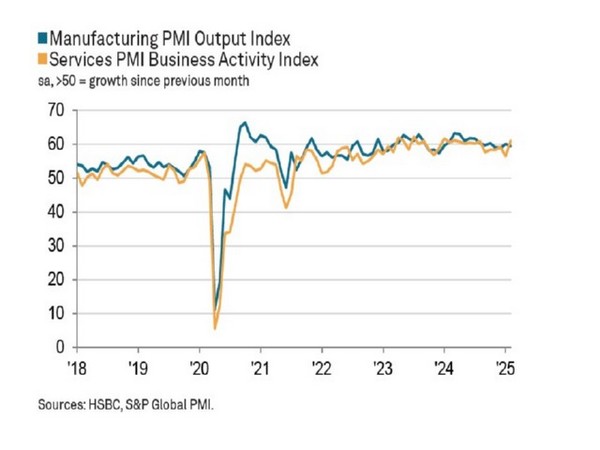

On a standalone basis, revenue and EBITDA for FY20 declined on account of general economic slowdown and start of the lockdown in major economies of the world during the month of March, the company said.

Despite the economic slowdown, the company generated net cash flow from operations of Rs 3,519 crore on a standalone basis in FY20 (before meeting its capex spend of over Rs 2,800 crore) on the back of efficient operations and working capital management during the year.

On a standalone basis, the company continues to maintain a comfortable liquidity position with liquid investments of Rs 2,093 crore as on March 31.

The board of directors has recommended a dividend of Rs 4 per share. The total outflow on account of the dividend will be Rs 263 crore.

In terms of the provisions of the Finance Act 2020, dividend will be taxed in the hands of shareholders at applicable rates of tax and the company will withhold tax at source appropriately.

Grasim said it has been in the process of executing total capex plan of Rs 7,800 crore (at standalone level) for raising capacities in both the viscose fibre and chemical businesses apart from ongoing modernisation capex at various plants.

The capex plans are currently being reviewed in the context of the current economic environment.

“With its strong financial, operational excellence and diverse product portfolio (cement, financial services, viscose and chemicals), the company is well poised to withstand temporary disruptions and sustain leadership across its businesses,” it said.

(ANI)