New Delhi [India], January 22 (ANI): Foreign portfolio investors (FPIs) have sold assets worth about Rs 15,236 crore in Indian stock markets so far in 2023 (till January 20), the latest data from National Securities Depository showed. Foreign investors are apparently cautious amid risks of the potential return of Covid, besides looming global recession worries as flagged by various agencies.

In November and December 2022, foreign portfolio investors (FPIs) were net buyers. They had bought assets worth Rs 36,239 crore and Rs 11,119 crore, respectively. Prior to November, they were net sellers in September and October amid the then-strong US dollar index, weak rupee, and tightening of monetary policy.

Notably, barring some exceptions, foreign portfolio investors (FPIs) had been selling equities in the Indian markets for over a year, which started in October 2021 for various reasons. In 2022, foreign portfolio investors overall sold Rs 121,439 crore worth of stocks in India on a cumulative basis, the data available on the NSDL website showed.

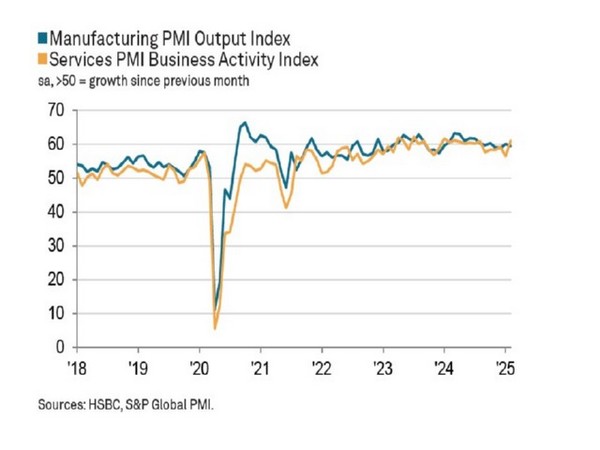

Tightening monetary policy in advanced economies including rising demand for dollar-denominated commodities, and strength in the US dollar had triggered a consistent outflow of funds from Indian markets. Investors typically prefer stable markets in times of high market uncertainty.

Meanwhile, a World Bank report has projected that the global economy will grow by a mere 1.7 per cent in 2023, down from the 3 per cent it estimated in its earlier forecast. In 2024, the global economy is projected to grow by 2.7 per cent, against the previous estimate of 3 per cent.

Given fragile economic conditions, any new adverse development such as higher-than-expected inflation, an abrupt rise in key interest rates to contain it, a resurgence of the Covid-19 cases, or escalating geopolitical tensions could push the global economy into recession, the World Bank report said. (ANI)