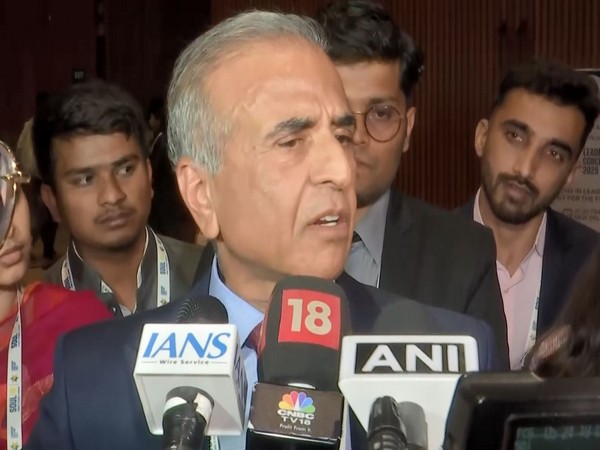

New Delhi [India] July 25 (ANI): Speaking at a post-budget interaction with industry leaders, Revenue Secretary Sanjay Malhotra said on Thursday that the government is working on a revised direct tax code, which will be released in six months for wider consultations.

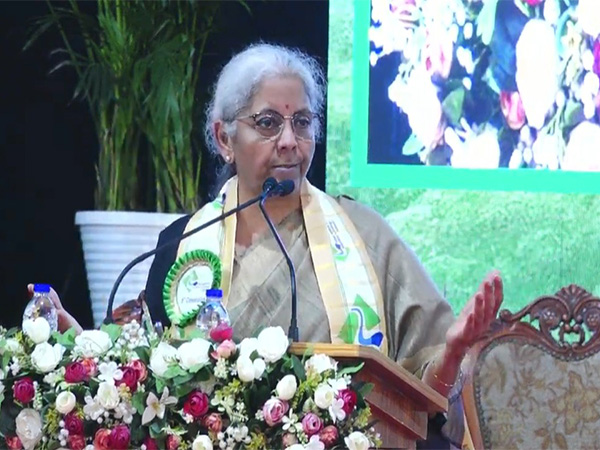

Revenue Secretary, while addressing industry body FICCI’s interactive session on Union Budget 2024-25 said, “We will have a consultation process and how it will happen that we will decide. We would like to have a collaborative approach for implementation.”

The Revenue Secretary further stated that the efforts of the government will be to provide a hassle-free, simple, and collaborative approach towards the implementation of taxes.

“Our approach towards taxation has always been and will continue to be in the mode of collaboration and not confrontation. The purpose of our proposals, both on the policy side as well as on the implementation side, are to collect taxes from wherever they are due but do it in a manner that gives respect and trust to the taxpayers and collect them in a smooth and hassle-free manner,” he added.

Highlighting the broad themes of the Union Budget, Malhotra said that the whole effort in the Budget is to make the tax process simpler for the taxpayers.

On the indirect tax front, the abolition of angel tax, decriminalizing the laws, and reduction in duties are some of the budget proposals that will benefit the industry.

Ravi Agarwal, Chairperson of the Central Board of Direct Taxes, said that the new tax regime with new slabs and rates is beneficial for all and around two-thirds of the total taxpayers are filing income tax returns through the new tax regime. He also highlighted the benefits of rationalization of taxation on capital gains in different asset categories.

Sanjay Kumar Agarwal, Chairperson, Central Board of Indirect Taxes and Customs, said that the indications on the indirect taxes in the Union Budget 2024-25 are clear that their is a need for simplified taxation and rationalized rates to enhance supply chains and ensure the industry remains competitive globally.

FICCI’s former president Harsh Pati Singhania applauded the budget and said, “By addressing the near-term challenges, while keeping an eye on the long-term, the government has assured that this budget is growth-oriented, inclusive, and will create opportunities for all sections of the society.”

Singhania added that the indirect tax proposals in the budget are aligned with the focus on promoting domestic value addition, reducing trade bottlenecks, curbing litigation, and improving the ease of doing business.

“While introduction of Vivad Se Vishwas scheme in respect of direct tax matters is a step in the right direction, we believe a similar scheme to resolve pending disputes under customs is much needed and would go a long way in reducing litigation on customs matters,” Singhania noted. (ANI)