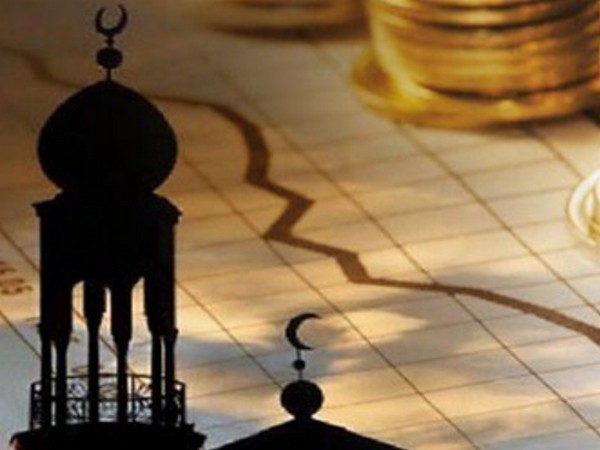

Singapore, July 5 (ANI): Islamic banks will likely continue to expand faster than conventional peers’ in Southeast Asia, S&P Global Ratings said on Monday after analysing growth drivers and risks posed to the sector by Covid-19.

It said Islamic banks benefit from government support, a large Muslim population in many countries in Southeast Asia, and strong demand for Sharia-compliant financial products.

Additional benefits include increased standardisation of contracts and potential unification of global legal and regulatory framework for Islamic finance.

Nevertheless, these institutions like conventional banks have seen disruptions due to the pandemic. Amid new waves of infection, Islamic bank growth rates will likely moderate and asset quality stress persist for longer, said S&P.

High levels of forbearance for both conventional and Islamic banks mask the true extent of weak loans in these emerging markets. Temporary relief measures will aid stressed borrowers though recognition of problem loans will be delayed.

This has potentially masked asset quality problems and understated the impact on earnings and capital, said S&P.

In addition, the abrupt business and operational disruptions brought by the pandemic has forced a rapid change of mindset and strategies of Islamic lenders which are looking more actively at digitalising their offerings and leveraging more on fintech partnerships and outsourcing.

The FAQ addressed these issues as well as other questions investors have, including on downside risk, mergers and acquisitions, and comparative growth of the sector among Brunei, Indonesia, Malaysia and the Philippines. (ANI)