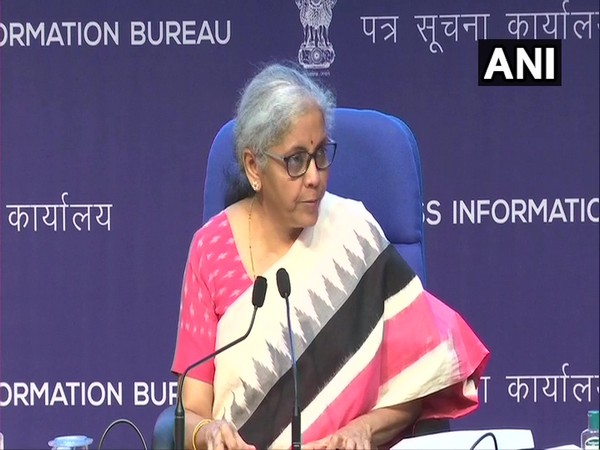

New Delhi [India], June 28 (ANI): The Centre on Monday announced Credit Guarantee Scheme to facilitate new lending among the smallest borrowers and stated that this includes the ‘stressed borrowers’.

While addressing a press conference here on Monday, Union Finance Minister Nirmala Sitharaman said, “Under the Credit Guarantee Scheme we aim to reach out to 25 lakh people who are absolutely small borrowers. Loan to be given to the smallest borrowers by Microfinance Institutions. A maximum Rs 1.25 lakhs amount to be lent.”

“The interest rate under the new Credit Guarantee Scheme is 2 per cent below RBI prescribed rate, with a loan duration of 3 years,” the Union Finance Minister stated.

“The focus will be on new lending and not on repayment of the old loans. Stressed borrowers except NPAs to be covered under the new Scheme,” she said.

During the press conference, a Rs 1.1 lakh crore loan guarantee scheme for COVID-affected sectors was also announced. Of this, Rs 50,000 crore has been allocated to the health sector and Rs 60,000 crore for other sectors.

Sitharaman said, “We are announcing about eight economic relief measures, of which four are absolutely new and one is specific to health infrastructure. For Covid-affected areas, Rs 1.1 lakh crores credit guarantee scheme and Rs 50,000 crores for health sector.”

Apart from these, an additional Rs 1.5 lakh crore under the Emergency Credit Line Guarantee Scheme (ECLGS) has been announced. This is additional to the Rs 3 lakh crore announced under the scheme last year. (ANI)