New Delhi [India], February 2 (ANI): Tax experts, industry observers, and banking leaders have praised the Union Budget 2025-26 for its emphasis on economic growth, tax relief, and innovation across various sectors.

Announced by Finance Minister Nirmala Sitharaman on Saturday, the budget includes significant tax rebates, such as a complete income tax exemption for individuals earning up to Rs 12 lakh annually. For salaried taxpayers, this threshold increases to Rs 12.75 lakh, factoring in a Rs 75,000 standard deduction.

Sameer Gupta, National Tax Leader at EY India, highlighted the budget’s focus on economic progress. “The enhanced tax rebates will ensure more disposable income, stimulating consumption and fueling economic activity,” he said. He also emphasized that the push for innovation, particularly in agriculture and skill development, would drive sustainable, technology-driven progress.

Debadatta Chand, Managing Director and CEO of Bank of Baroda, noted the impact on consumer spending. “The concessions on the income tax front will put more money in the hands of taxpayers and would boost consumption in the economy,” he said.

Tribhuwan Adhikari, MD and CEO of LIC Housing Finance, praised the budget’s approach to strengthening economic growth and increasing disposable income for individuals, particularly middle-class salaried professionals. “The exemption of income tax for earnings up to INR 12 lakh will significantly impact affordable housing demand, making it easier for individuals to plan homeownership,” he said.

Preeti Sharma, Partner at BDO India, pointed out the significant changes for individual taxpayers. The new tax regime raises the rebate threshold to Rs 12 lakh, effectively exempting them from paying taxes. She explained that a salaried individual earning Rs 12.75 lakh will save Rs 80,000 in taxes due to the increased rebate and standard deductions.

The revised tax slabs, with the new tax threshold raised to Rs 4 lakh, provide relief to taxpayers across all income groups. “The changes will encourage higher tax compliance and ensure a more equitable tax burden distribution,” Sharma said. She further indicated that the government’s efforts to simplify tax rules and focus on a single tax regime for individuals point toward streamlining taxation procedures. “While the fine print of the New Income-Tax Bill is yet to be revealed, it reflects the government’s intent to align with the new tax regime,” she added.

Amit Nigam, Executive Director and COO of BANKIT, emphasized that the revised income tax rates will boost disposable income, which, in turn, will drive consumption and economic activity. He explained that this would create new opportunities for small businesses and digital financial services. “The budget’s focus on fueling economic resilience, especially in urban areas, is a positive step towards creating a robust and inclusive economic environment,” Nigam noted.

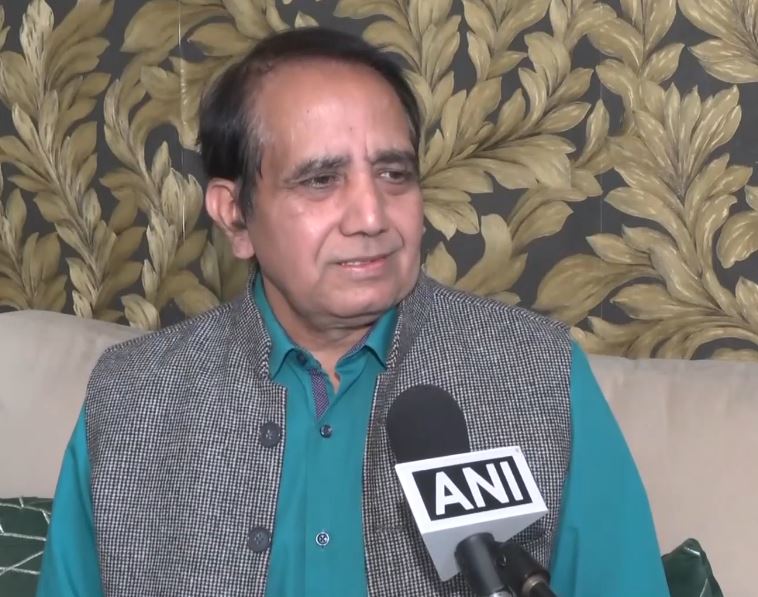

Naveen Wadhwa, Vice President at Taxmann, stated, “The gap between the tax payable under the new and old tax regimes is so vast that it effectively ends the old tax regime. The new tax regime is the most advantageous option for every taxpayer.”