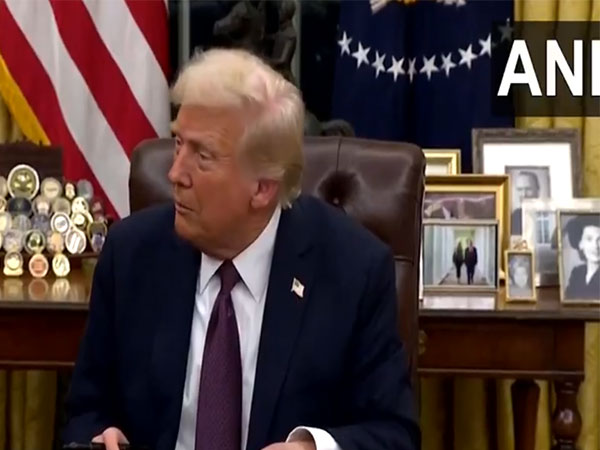

Mumbai (Maharashtra) [India], February 7 (ANI): In his first Monetary Policy announcement on Friday, Reserve Bank of India (RBI) Governor Sanjay Malhotra stated that the Monetary Policy Committee (MPC) had unanimously decided to reduce the policy rate by 25 basis points (bps) from 6.5 per cent to 6.25 per cent.

Malhotra highlighted the challenges posed by the global economic landscape, noting that while high-frequency indicators suggest resilience and expansion in trade, overall global growth remains below historical averages. “Progress on global disinflation is stalling, hindered by services price inflation,” Malhotra said.

Discussing global financial market dynamics, Malhotra pointed out that expectations regarding the size and pace of rate cuts in the United States had led to a strengthening of the US dollar. He said, “The global economic backdrop remains challenging. The global economy is growing below the historical average, even though high-frequency indicators suggest resilience, along with continued expansion in trade. Progress on global disinflation is stalling, hindered by services price inflation.”

This, in turn, resulted in hardened bond yields and significant capital outflows from emerging markets, causing sharp currency depreciations and tighter financial conditions. He said, “With receiving expectations on the size and pace of rate cuts in the US, the US dollar has strengthened. Bond yields have hardened, emerging market economies have witnessed large capital outflows, leading to sharp depreciation of their currencies and tightening of financial conditions, divergent trajectories of monetary policy across advanced economies, lingering geopolitical tensions and elevated trade and policy uncertainties have exacerbated financial market volatility.”

He also emphasized the impact of geopolitical tensions and policy uncertainties on market volatility, adding that such an unpredictable global environment has posed significant policy trade-offs for emerging economies.

Despite these headwinds, Malhotra assured that the Indian economy remains strong and resilient, though not entirely immune to external pressures. “The Indian rupee has come under depreciation pressure in recent months,” he acknowledged. However, he reassured that the RBI is actively using all available tools to address the multifaceted challenges facing the economy.

The MPC began its three-day meeting to discuss and set the new interest rates on February 5, 2025. During the previous MPC meeting in December 2024, the RBI announced a 50 basis point cut in the cash reserve ratio (CRR), making it 4 per cent. However, it kept the benchmark repo rate unchanged at 6.5 per cent. (ANI)

RBI projects GDP growth at 6.7% for FY26; Inflation in FY25 to remain at 4.8%

Mumbai (Maharashtra) [India], February 7 (ANI): The Reserve Bank of India on Friday has projected real GDP growth for FY25 at 6.4 per cent, expecting economic activity to pick up in the second half, driven by improvements in agriculture and manufacturing.

RBI Governor Sanjay Malhotra announcing the outcome of the Monetary Policy Committee meeting stated that for FY26, GDP growth is estimated at 6.7 per cent, with quarterly projections as Q1 FY26: 6.7 per cent, Q2 FY26: 7.0 per cent, Q3 FY26: 6.5 per cent and Q4 FY26: 6.5 per cent.

On the inflation front, the central bank expects Consumer Price Index (CPI) inflation to ease to 4.8 per cent in FY25, with Q4 FY25 inflation projected at 4.4 per cent. For FY26, inflation is forecasted at 4.2 per cent, with quarterly estimates as Q1 FY26: 4.5 per cent, Q2 FY26: 4.0 per cent, Q3 FY26: 3.8 per cent and Q4 FY26: 4.2 per cent.

Announcing highlights from the recently held RBI‘s Monetary Policy Committee decisions Governor Malhotra said that the inflation has declined, supported by a favourable outlook on food prices and the continued transmission of past monetary policy actions. It is expected to further moderate in 2025-26, gradually aligning with the target.

Malhotra highlighted that food inflation pressures are expected to soften significantly with a favorable rabi crop, contributing to a stable inflation outlook.

Despite global economic uncertainties, India continues to demonstrate resilience. However, Malhotra acknowledged that the economy cannot remain immune to external pressures. The Purchasing Managers’ Index (PMI) for manufacturing indicates continued resilience, while rural demand is on the rise, even as urban demand remains subdued.

Key factors supporting growth include tax relief measures in the Union Budget, improved agricultural output, robust business sentiment, and continued policy support from the government. The RBI also plans to strengthen its economic forecasting capabilities using Artificial Intelligence (AI) and will continue its flexible inflation targeting framework to maintain macroeconomic stability.

India’s foreign exchange reserves remain robust, standing at over USD 630 billion as of January 31, 2025. This provides an import cover of more than 10 months, offering strong external stability. The RBI expects the current account deficit to remain within sustainable levels for the fiscal year, ensuring a stable macroeconomic environment.

The latest rate cut comes after a prolonged tightening cycle, where the RBI raised the repo rate from 4 per cent to 6.5 per cent between May 2022 and May 2023 to combat inflation. The reduction signals a shift towards supporting economic growth while ensuring price stability.

With inflation expected to stay within the RBI‘s 4 per cent target range, and economic activity set to improve, the central bank’s move is likely to provide relief to borrowers and boost consumption and investment in the coming months.

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) has decided to reduce the policy repo rate by 25 basis points (bps) from 6.5 per cent to 6.25 per cent, marking the first rate cut since May 2020. The stance remains neutral, with RBI Governor Sanjay Malhotra emphasizing that inflation has moderated and is expected to align further with the target in FY26. (ANI)