New Delhi [India], February 2 (ANI): The Union Budget 2024-25, presented by Union Finance Minister Nirmala Sitharaman in Parliament on Saturday, provided major relief to the salaried class with no income tax on an average monthly income of up to Rs one lakh. This move aims to boost household savings and consumption while also focusing on four key engines of development—agriculture, MSMEs, investment, and exports.

The Finance Minister’s announcement on tax relief means that salaried individuals earning up to Rs 12.75 lakh annually will pay no income tax. However, opposition parties criticized the budget, arguing that it failed to address unemployment and accused the government of “throttling MGNREGA.”

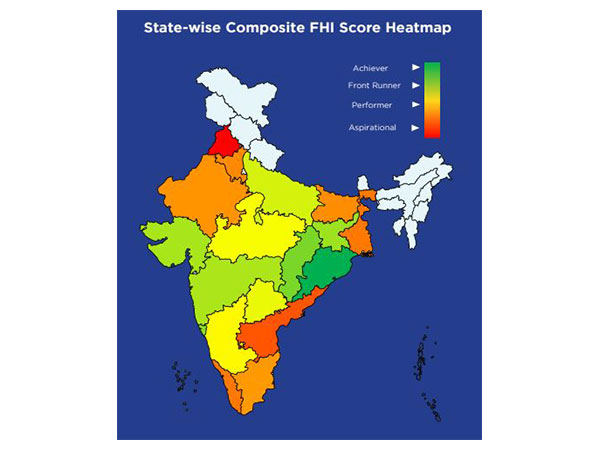

Sitharaman announced the launch of the ‘Prime Minister Dhan-Dhaanya Krishi Yojana,’ which will cover 100 districts with low agricultural productivity. Additionally, the government will implement the ‘Mission for Aatmanirbharta in Pulses,’ focusing on “tur, urad, and masoor.”

The Finance Minister projected that the fiscal deficit for FY-25 would be 4.8 per cent, with a target to reduce it further to 4.4 per cent in FY-26. She also announced an increase in credit with a guarantee cover for MSMEs, raising the limit from Rs 5 crore to Rs 10 crore.

A National Manufacturing Mission will be introduced to support small, medium, and large industries, furthering the “Make in India” initiative. The budget also includes the establishment of 50,000 Atal Tinkering Labs in government schools over the next five years and a Centre of Excellence in Artificial Intelligence for education, with a total outlay of Rs 500 crore.

Gig workers will receive identity cards and be registered on the e-Shram portal, granting them healthcare benefits under the PM Jan Arogya Yojana. Additionally, Rs 1 lakh crore has been allocated for an urban challenge fund under the ‘Cities as Growth Hubs’ initiative. A modified Udan scheme will enhance regional connectivity to 120 new destinations.

The Finance Minister also announced an increase in the Foreign Direct Investment (FDI) limit for the insurance sector from 74 per cent to 100 per cent. Furthermore, Jan Vishwas Bill 2.0 will be introduced to decriminalize over 100 provisions in various laws.

Key amendments to the Atomic Energy Act and the Civil Liability for Nuclear Damage Act were also highlighted. A Nuclear Energy Mission, with an outlay of Rs 20,000 crore, will focus on research and development of Small Modular Reactors (SMRs). The mission aims to develop at least 100 gigawatts (GW) of nuclear energy by 2047, aligning with India’s “Viksit Bharat” vision.

Sitharaman announced that five indigenously developed SMRs would be operational by 2033. She emphasized the government’s priorities in accelerating economic growth and ensuring inclusive development.

The PM SVANidhi scheme will be revamped with enhanced loans from banks, UPI-linked credit cards with a Rs 30,000 limit, and capacity-building support. Additionally, the Finance Minister raised the threshold for Tax Deduction at Source (TDS) on rent from Rs 2.40 lakh per annum to Rs 6 lakh per annum.

The second Asset Monetization Plan for the period 2025-30 was also announced. In a move aimed at aiding patients with severe chronic ailments, the government expanded the list of life-saving drugs and medicines fully exempted from Basic Customs Duty (BCD).

On the capital expenditure front, the government allocated Rs 11.21 lakh crore for capital expenditure in the Union Budget 2025-26. This marks a 0.9 per cent increase over last year’s Budget Estimate of Rs 11.11 lakh crore. However, compared to the revised estimate of Rs 10.18 lakh crore for 2024-25, the 2025-26 allocation is significantly higher. Capital expenditure (capex) is used to set up long-term physical or fixed assets.

Industry leaders praised the budget, calling it progressive. Sitharaman received warm applause from BJP members and allies after her speech, with Prime Minister Narendra Modi congratulating her. Union Ministers JP Nadda and Jyotiraditya Scindia were among those who greeted the Finance Minister. PM Modi also briefly interacted with her as NDA MPs celebrated. After presenting the Budget, Sitharaman met Lok Sabha Speaker Om Birla in Parliament House.

However, Congress and other opposition parties criticized the Union Budget. Former Finance Minister and Congress leader P. Chidambaram accused Sitharaman of “walking on a worn-out path.” He claimed that both she and Prime Minister Modi ignored the Chief Economic Advisor’s recommendation to deregulate, and instead, the government’s “stranglehold” on people’s activities was tightening.

At a press conference, Chidambaram argued that the economy would continue on the same trajectory, delivering no more than 6 to 6.5 per cent growth in 2025-26.

Trinamool Congress leader Abhishek Banerjee dismissed the budget as a political document aimed at securing votes in Bihar while disregarding the needs of West Bengal.

The Trinamool Congress posted on X, criticizing the Budget for failing to support the poor, promote balanced growth, or uphold federalism.