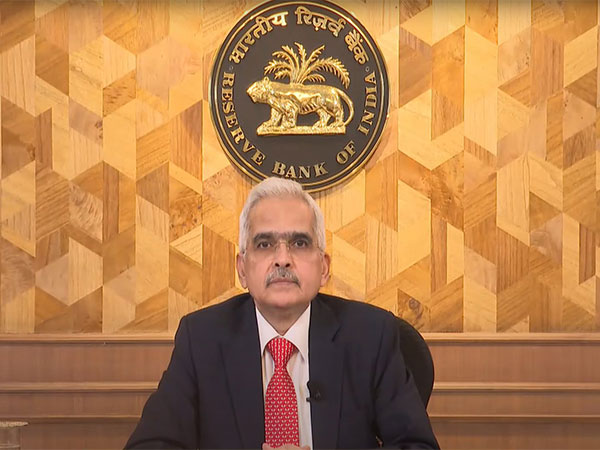

Mumbai (Maharashtra) [India], December 6 (ANI): The Reserve Bank of India (RBI) Governor Shaktikanta Das announced to cut the cash reserve ratio (CRR) for all banks by 50 basis points to 4 per cent of net demand and time liabilities (NDTL) in two tranches of 25 basis points each, effective from December 14 and December 28 respectively.

By this, Rs 1.15 lac crore of liquidity will be infused into the banking system. This will enhance liquidity in the economy substantially.

RBI has also hiked the inflation projection for FY25 from 4.5 per cent to 4.8 per cent. Quarter-wise, inflation is forecasted at 5.7 per cent for Q3 and 4.5 per cent for Q4. For FY25-26, CPI inflation is projected at 4.6 per cent in Q1 and 4 per cent in Q2.

“Despite some softening, lingering food price pressures will keep headline inflation elevated in the third quarter of FY24. However, a good Rabi season, supported by favourable soil moisture and reservoir levels, is expected to ease food inflation pressures. Seasonal winter corrections in vegetable prices and record Kharif production should also contribute to moderation,” Das stated.

He cautioned, however, that domestic edible oil prices, influenced by import duty hikes and rising global rates, require close monitoring.

India’s real GDP growth for the second quarter of FY24 slowed to 5.4 per cent, significantly lower than anticipated. The deceleration was primarily attributed to a sharp decline in industrial growth, which fell from 7.4 per cent in Q1 to 2.1 per cent in Q2.

This slowdown was linked to weaker performance in manufacturing, contractions in mining activity, and reduced electricity demand.

The governor highlighted that the weakness in manufacturing was limited to specific sectors such as petroleum products, iron and steel, and cement.

Encouragingly, the governor noted, “High-frequency indicators suggest the slowdown bottomed out in Q2, with recovery driven by festive demand and rural activity pickup.”

Das emphasized the resilience of the global economy in 2024, despite challenges such as rising U.S. dollar strength, hardening bond yields, and volatile financial markets.

However, he warned of potential risks from rising protectionism, which could hinder global growth and inflate prices. The MPC also acknowledged downside risks to domestic growth, including high inflation, adverse weather events, geopolitical uncertainties, and financial market volatility.

“High inflation reduces disposable incomes, dampens private consumption, and negatively impacts real GDP growth,” Das noted.

The MPC reiterated its focus on durable price stability as the foundation for high economic growth. While the recent surge in inflation above the 6 per cent tolerance band in October raised concerns, the committee expects easing food inflation and favourable agricultural output to stabilize prices in the coming quarters. (ANI)

Economists reacts to RBIs decision to keep repo rate unchanged and cut CRR to infuse liquidity

New Delhi [India], December 6 (ANI): The Reserve Bank of India (RBI) kept its key interest rates unchanged on Friday but cut the cash reserve ratio by 50 basis points to bring enough liquidity in the banking system.

The Monetary Policy Committee decided to keep the reo rate unchanged at 6.5 per cent and Cut CRR by 50 basis points to 4 per cent to infuse liquidity in the banking system and lower interest rates.

Eminent economists, reacting to the RBI‘s says that the apex bank has opted for a dual approach to tackle the challenges of inflation and slowing economic growth.

Dharmakirti Joshi, Chief Economist at CRISIL, remarked, “The CRR was cut to prevent excessive draining of liquidity from the economy, which typically curbs economic growth.”

On RBI revising GDP growth substantially from 7.2 per cent to 6.6 per cent for FY25, Joshi says “The sharper-than-expected gross domestic product (GDP) slowdown in the second quarter led the RBI to revise lower its projection by a significant 60 bps to 6.6 per cent.”

The RBI decision comes amidst, the sluggishness in the second quarter growth, dipping to 5.4 per cent.

Mayank Joshipura, Vice Dean, Research and Ph.D. Programme, Professor (Finance), NMIMS said, The second quarter GDP growth of 5.4 per cent signals widespread slowdown and it needs to be addressed by bold moves.

“Today, RBI has tried to improve banking system liquidity by cutting CRR by 0.5%. However only the repo rate cut going forward will bring down the cost of borrowing and EMIs and boost consumption and arrest the economic slowdown.” Says Joshipura.

In his remarks, The RBI Governor Shakatikanta Das emphasized central banks focus on inflation control than growth. But economists believe a rate cut is likely in the February policy.

Abhishek Pandya, Research Analyst, StoxBox said, “We expect the RBI to initiate a 25 bps rate cut in the February 2025 policy meeting, with further room for a downward revision to GDP.”

Dr Niranjan Shastri, Associate Professor (Finance) at SBM – SVKM’s NMIMS noted, “While the rate hike pause aims to support economic growth, the focus remains on controlling inflation. The reduction in CRR will inject liquidity, potentially boosting credit and economic activity.”

The move was also lauded by industry leaders. Hemant Jain, President of PHDCCI, stated, “We appreciate the calibrated steps undertaken by RBI to cut CRR significantly from 4.5% to 4 per cent. It will not only enhance the liquidity in the economy but also boost business sentiments as it signifies the futuristic softening of interest rates in the country” (ANI)

Industry welcomes CRR cut, anticipates rate cut to follow

New Delhi [India], December 6 (ANI): Industry bodies welcomed the overall RBI monetary policy announcements made on Friday.

Commenting on monetary policy, Harsha Vardhan Agarwal, President, FICCI said while the Reserve Bank of India’s stance on the repo rate was widely expected, the industry body welcomes the 50-bps cut in the Cash Reserve Ratio (CRR) rate.

“This move is well-timed and practical and should help ease out the liquidity situation supporting credit and overall growth.”

“On the inflation front, the prices are expected to moderate in the latter part of the current fiscal year. We look forward to a cut in repo rate in the next policy statement,” added Agarwal.

Food prices have been driving the current spurt in prices and a seasonal correction is on anvil.

“It is pertinent to ensure a seamless supply-side framework through better planning, logistics and distribution management of food items leveraging careful monitoring of production data,” Agarwal of FICCI said.

Chandrajit Banerjee, Director General of the Confederation of Indian Industry (CII), also welcomed the 50-bps cut in the cash reserve ratio, asserting that it will help ensure the availability of additional resources for all productive sectors of the economy, especially in anticipation of a near-term tightening of systemic liquidity.

“This was a specific CII ask along with a request for moderation in headline interest rates,” Banerjee added.

“However, we draw satisfaction from the overall statement that the neutral stance has been maintained and with the anticipated easing of inflation, we can expect rate cuts in the foreseeable future.”

With these measures, CII anticipates that there will be a better balance between growth and inflation management.

The Reserve Bank of India (RBI) decided to keep the repo rate unchanged at 6.5 per cent for the 11th consecutive time, marking a continuation of its neutral monetary policy stance. The RBI downwardly revised GDP forecast for 2024-25 to 6.6 per cent from 7.2 per cent earlier.

The RBI Governor announced that the CRR has been cut by 50 basis points from 4.5 per cent to 4 per cent. This the Governor had said will infuse Rs 1.15 lac crore of liquidity into the banking system.

Further, the retail inflation projection for 2024-25 has been hiked from 4.5 per cent to 4.8 per cent. (ANI)