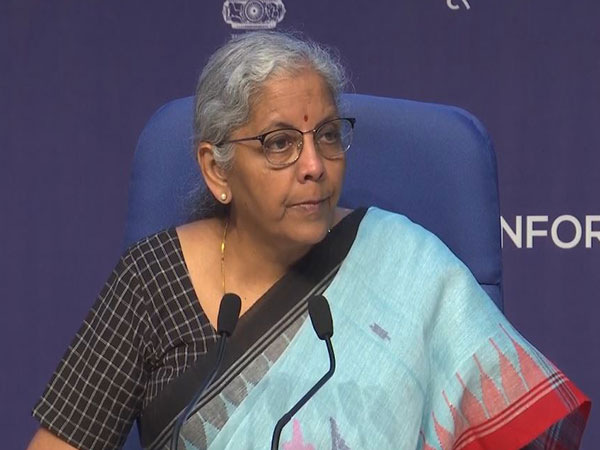

New Delhi [India], October 7 (ANI): The GST Council at its meeting held here on Saturday recommended that flour, which has at least 70 per cent millets, will attract zero per cent tax if sold in loose form and 5 per cent if it is sold pre-packaged and labelled form. The decision was taken at the GST meeting chaired by Finance Minister Nirmala Sitharaman.

Addressing a press conference after the meeting, Sitharaman said the GST Council wanted to participate in the year of millets.

“One of the most important, which I like to say with a sense of happiness that the GST Council wanted to participate in the year of millets and therefore GST’s role in the promotion of millets is seen in that.

Food preparations of millet flow in powder form containing at least 70 per cent millets by weight, they fall under the category of HS 1901. In powder form millets being blended with any other flour, where the millet composition is 70 per cent, we state that they will be having zero per cent GST if sold in other than pre-packaged and labelled form,” she said “Zero per cent if they are sold loose, and five per cent only if sold pre-packaged and in a labelled form,” she added.

An official release later said that a decision has been taken on GST rates on “food preparation of millet flour in powder form, containing at least 70 per cent millets by weight”, falling under HS 1901, with effect from the date of notification. “Zero per cent if sold in other than pre-packaged and labelled form. Five per cent if sold in pre-packaged and labelled form,” it said. (ANI)