New Delhi [India], February 1 (ANI): There are ample indicators to support the statement that the Indian economy is backed by strong macroeconomic fundamentals. Be it capital expenditure, the asset quality of banks, foreign exchange reserves, GST collections, fiscal consolidation path, and convergence of wholesale and retail inflation, Budget document data showed all these indicators to be on strong ground.

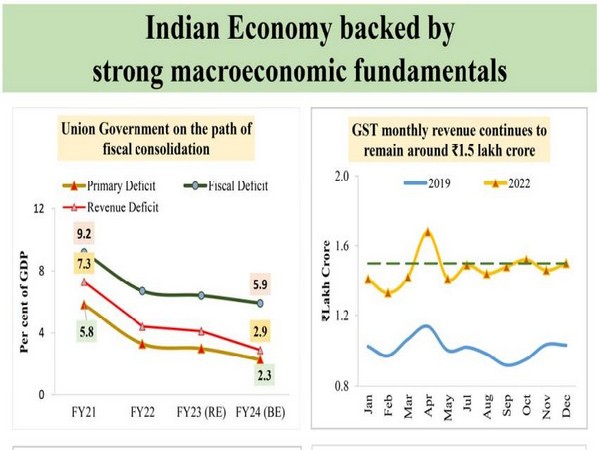

Coming to fiscal deficit, it has steadily declined from 7.3 per cent in 2020-21 to 5.9 per cent budgeted for 2023-24. In 2022-23, it was pegged at 6.4 per cent.

GST collections are also at their peak. The gross GST revenue collected in the month of January 2023 was approximately Rs 155,922 crore. This is for the third time, in the current financial year, GST collection has crossed Rs 1.50 lakh crore mark. The GST collection in January 2023 is the second highest next only to the collection reported in April 2022. Over the last years, various efforts have been made to increase the tax base and improve compliance. Monthly GST collections, on an average, have been in a range of Rs 1.5-1.6 lakh crore for months now.

Coming to capital expenditure, the allocation has grown four times since 2015-16, from Rs 2.5 lakh crore to Rs 10.0 lakh crore (Budget estimate for 2023-24). “Capital investment outlay is being increased steeply for the third year in a row by 33 per cent to ` 10 lakh crore, which would be 3.3 per cent of GDP. This will be almost three times the outlay in 2019-20,” finance minister Nirmala Sitharaman said in her Budget speech on Wednesday.

This increase in recent years, she said, is central to the government’s efforts to enhance growth potential and job creation, crowd-in private investments, and provide a cushion against global headwinds.

Further, asset quality of banks in terms of NPAs too have seen a steady decline.

Since March 2020 till September 2022, NPAs have declined from 8.2 per cent to 5.0 per cent, Budget document showed.

Much talked about matter in recent times was about India’s foreign exchange reserves. India’s foreign exchange reserves rose by whopping USD 1.727 billion to USD 573.727 billion in the week ending on January 20, thus hitting a six-month high, according to Reserve Bank of India’s latest data. The government today said it has sufficient reserves to cover nine month of imports. In October 2021, the country’s foreign exchange reserves reportedly touched an all-time high of about USD 645 billion.

The last macroeconomic indicator inflation too is witnessing a convergence, meaning a decline in difference between wholesale and retail in terms of percentage points. India’s retail inflation was above RBI’s six per cent target for three consecutive quarters, and had managed to fall back to the RBI’s comfort zone in November 2022.

India’s retail inflation rate based on Consumer Price Index declined to 5.88 per cent in November from 6.77 per cent during the previous month. Under the flexible inflation targeting framework introduced in 2016, the RBI is deemed to have failed in managing price rises if the CPI-based inflation is outside the 2-6 per cent range for three quarters in a row.

Accordingly, India’s wholesale inflation based on the Wholesale Price Index for the month of December 2022 was at 4.95 per cent (provisional), against the previous month’s 5.89 per cent.

In October, it was at 8.39 and has been falling since then. Notably, the wholesale price index (WPI)-based inflation had been in double digits for 18 months in a row till September. (ANI)