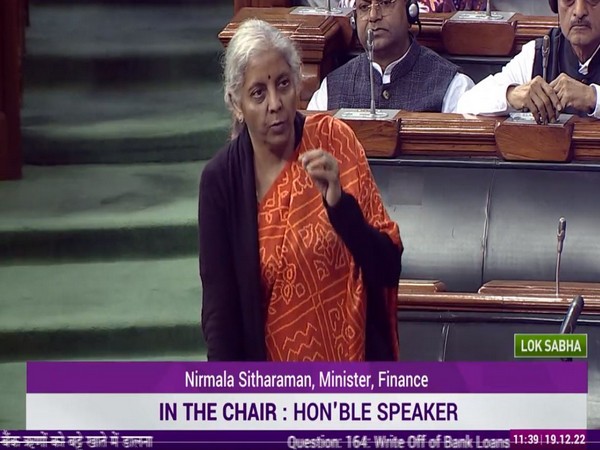

New Delhi [India], December 19 (ANI): Union finance minister Nirmala Sitharaman on Monday said the processes for recovering money for depositors post bank loan write-offs are “layered” while noting that small depositors are put to “extreme difficulty” in the process of justice delivery.

“Unfortunately the processes are so layered that by the time justice is sought to be delivered, many of the small depositors are put to extreme difficulty,” Sitharaman said in Lok Sabha.

Her response in the Lower House of Parliament was in reply to a question by member Supriya Sule citing on the process of recovering money from banks, while citing a specific example of the Punjab and Maharashtra Co-operative (PMC) Bank issue. “The processes are very layered. There are times when even if there are defaulters…and even if their assets are attached, it requires very complicated processes through the court,” Sitharaman further responded to Sule.

Sitharaman also mentioned there is “definitely a need” to look at how the government can simplify the process without denying justice to the depositors.

Particular to PMC Bank, the Union finance minister said: “We have particularly in this case approached the court saying could you please release a portion of what was attached by the agencies which went to enforce it. The courts would not allow you to detach that element or portion to give relief to particular bank depositors.”

Sule, in her question, said the intention may be good, but the processes are so long that the depositors and the investors do not get their money returned. “If they are looking at recovering of money, I will give a specific example of PMC Bank. Their intention may be good, but the processes are so long that the depositors and the investors do not really get their money back. They do the write-off, but who really benefits from it? Is there any way by which they can shorten the process?” Sule questioned.

In September 2019, the RBI reportedly imposed curbs on the bank, saying that depositors would not be allowed to withdraw more than Rs 1,000 for six months. The withdrawal limit was later raised to Rs 25,000, and then to Rs 40,000 in October 2019. Then on September 22, 2020, the RBI considered it necessary to supersede the Board of Directors of the PMC Bank in the interest of the depositors and to secure the proper management of the bank.

RBI had then said several factors such as huge losses incurred by the bank resulting in its entire net worth getting wiped out, and steep erosion in deposits continue to pose serious challenges in finding a workable plan for the revival of the bank. “The bank has also been making efforts for recovery of NPAs although the progress has been constrained because of the COVID-19 pandemic and legal complexities. Nevertheless, in the interest of the depositors, the PMC bank and the RBI are continuing to engage with the stakeholders to explore the possibility of finding a viable and workable solution for the resolution of the bank,” RBI said on September 22. (ANI)