Mumbai (Maharashtra) [India], September 20 (ANI): Chief Economic Advisor V Anantha Nageswaran on Tuesday said India is among the fastest growing fintech markets in the world with a market size of USD 31 billion in 2021 that is expected to reach USD 1 trillion by 2030.

Speaking at the Global Fintech Fest 2022 (GFF 2022) here, Nageswaran said, “A major shift towards a more equitable distribution of investment across sectors including InsurTechs, WealthTechs, etc, has started taking place. We are talking about bridging the digital divide and the economic divide. Therefore the focus now is on how the combination of technology and finance is enabling access to finance and access to opportunities.”

GFF 2022 is organized and presented by the Department of Economic Affairs, Ministry of Finance, Government of India, Reserve Bank of India, International Financial Services Centres Authority (IFSCA), National Payments Council of India, the Payments Council of India (PCI) and the Fintech Convergence Council (FCC).

This is the third edition of the Global Fintech Fest, and the first one where domain experts are participating from across the globe in person and virtually. Nageswaran further said that the next wave in the fintech sector could be the cash flow lending to MSMEs using Account Aggregator, UPI and OCEN. The lending potential of USD 3 trillion next year will be based on GST invoices and bank statements made available on Account Aggregator and banks adopting OCEN.

He said the government is now pivoting from digital financial inclusion to digital financial empowerment. This is being done through Jan Dhan 2.0, strong gender focus, PM SVAnidhi Scheme, eKYC and digital onboarding and protection of digital customers, said Nageswaran. Speaking on the growth of health insurance in India, Chief Executive Officer, National Health Authority RS Sharma, said, “The National Health Authority has successfully implemented two flagship programs – Ayushman Bharat -Pradhan Mantri Jan Aarogya Yojana (PMJAY) and the Ayushman Bharat Digital Mission that have transformed the health insurance industry.”

He said PMJAY is providing health insurance cover to over 500 million people at the bottom of the pyramid to the tune of Rs 5 lakhs per month, per family and is the world’s largest health insurance scheme. “Today we have a huge opportunity to digitize the entire health space that will ultimately impact the health insurance industry in this country,” stated Sharma.

He said the Centre has already built the enabling platform in the form of the ‘Health Claims Exchange’. He said the work is underway to develop the adapters from the providers’ and payers’ sides, after which the platform will ensure the interchangeability of information in a very seamless way. “With standardization and cost optimization, the Health Claims Exchange will be to India’s health technology what the JAM trinity was to the country’s fintech,” Sharma added.

Speaking about the barriers and drivers to grow digital payments for the next half a billion users, Praveena Rai, Chief Operating Officer, National Payments Corporation of India (NPCI) said, “As per the RBI Payments Vision 2025, digital payments are for everyone, everywhere, and every time, where everywhere and every time boils down to the quality of connectivity required to commit to digital payments and digital solutions. ‘Everyone’ challenges us the most because it needs to address some of the biggest barriers – affordability, access to identity, and literacy as we go deeper and broader into our markets and user base.” (ANI)

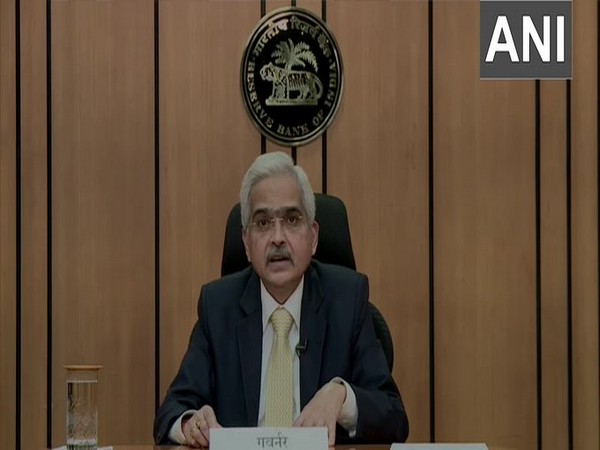

Fintech system in India has evolved, poised for giant leap: Shaktikanta Das

Mumbai (Maharashtra) [India], September 20 (ANI): Reserve Bank of India Governor Shaktikanta Das has said the fintech system in India has evolved and is poised for a giant leap. He was speaking at the Global Fintech Fest in Mumbai on Tuesday. “Technology, innovation and fintech are working in tandem and have contributed a lot in this sector. In our journey towards a higher sustainable system of financial inclusion, these forces have morphed into growth multipliers in this sector. We have leveraged a lot on these. We need to leverage more,” Shaktikanta Das said.

He said that there were a lot of opportunities in not only enhancing the scope and depth of the fintech segment but how it could deepen financial inclusion in the country’s march over the next 25 years when it will mark the 100th anniversary of Independence. “If all of us are together, the regulator as well as the players, we can create a lot of milestones in our journey.”

In the matter of central bank digital currency (CBDC), he said the central bank is working on a phased implementation of CBDC in both wholesale and retail segments and that RBI had proposed to first try it out in the wholesale before expanding into the retail segment. He also mentioned that phased implementation will give further fillip to digital ecosystem of the country.

Stressing on fintech innovation, he said India has seen exponential growth for technology enablers.

“Telecom penetration, availability of internet services, adoption of technological access to credit and deepening of financial inclusion have made significant progress in the financial sector and are continuing to make progress,” he said. Shaktikanta Das also added the regulatory sandbox was released in August 2019 with a view to foster innovation and that the RBI is in a select group of countries that have their own regulatory sandbox. (ANI)

RBI committed to support innovation in fintech: Shaktikanta Das

Mumbai (Maharashtra) [India], September 20 (ANI): Reserve Bank of India (RBI) Governor Shaktikanta Das said on Tuesday the central bank is committed to support innovation in fintech sector while keeping in mind consumer protection. “I wish to assure the FinTech community that the RBI will continue to encourage and support innovation. At the same time, we would expect the ecosystem to pay attention to governance, business conduct, regulatory compliance and risk mitigation frameworks,” Das said while addressing the Global Fintech Festival (GFF).

“The fintech road ahead will witness ever-growing traffic in addition to the large number of existing players who are already there. It is, therefore, imperative that every player on this road follows the traffic rules for his/her own safety and the safety of others,” he said. The National Payments Corporation of India (NPCI), the Fintech Convergence Council (FCC) and the Payment Council of India (PCI) organised the event.

Referring to the importance given to the fintech sector, Das said, “We have also created a new FinTech Department in the RBI from January 2022 to give focused attention to this evolving and dynamic sector. The objective of this department is not only to promote innovation, but also identify the associated challenges and opportunities and address them in a timely manner.”

All matters relating to facilitation of constructive innovations and incubations in the FinTech space, with wider implications for the financial sector and markets, are being dealt with by this department, in addition to inter-regulatory issues and international cooperation. The financial services industry in India has seen enormous transformation. Products like internet and mobile banking, electronic funds transfer, UPI, Aadhaar e-KYC, Bharat Bill Payment System (BBPS), QR Scan & Pay, digital pre-paid instruments and similar other initiatives have transformed the traditional banking operations, the RBI Governor said.

Banking hours have been transcended. We now have digital-mobile-anywhere-anytime banking. While several initiatives originated from the industry, the government and the regulators have created an enabling ecosystem to promote the FinTech sector. Initiatives like Startup India, Digital India, India Stack, Account Aggregators, Peer to Peer (P2P) lending platforms and 24×7 digital payment systems have proved to be key enablers. The Fintech ecosystem in India has indeed evolved and is poised for a giant leap, he added.

Das emphasized on the need for giving proper attention to governance issues. “As we continue to support technological advancement and innovation, it is equally important that adequate attention is also placed on governance and conduct issues. At the end of the day, sustainability of any FinTech activity or business is about enhanced customer protection, better cyber security and resilience, managing financial integrity and strong data protection,” he said. (ANI)