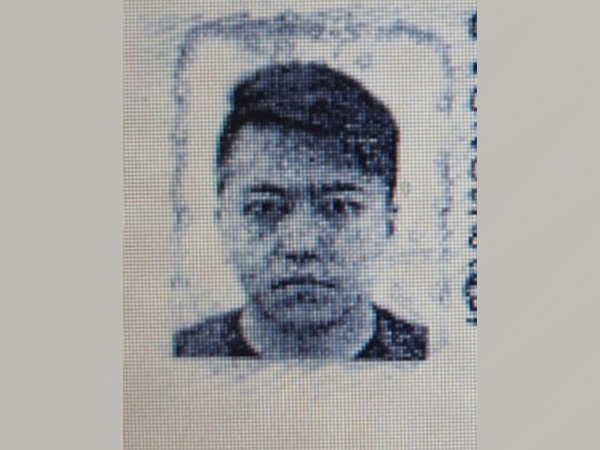

Lookout circular issued against Chinese national in mobile loan app scam

Bhubaneswar (Odisha) [India], July 13 (ANI): On the request of the Economic Offences Wing (EOW) of Odisha Police, the Bureau of Immigration (BOI) has issued a lookout circular against Liu Yi, a Chinese national and main accused in a mobile loan app scam, police said on Tuesday. “EOW has booked Liu Yi under various sections of IPC & Section 66 D of IT Act. He used to run many illegal mobile loan apps like KOKO Loan, JOJO Loan, Golden Lightning Loan, Silver Kredit Loan, Gold Cash loan, Speedy rupee Loan, Xpress credit Loan & others,” said JN Pankaj, DIG, EOW.

It is worth mentioning that in one APP alone there are more than 1.5 lakh downloads. It is suspected that they have cheated/ extorted lakhs of people across the country particularly targeting lower-middle-class people in the need of small loans, especially during the difficult times of COVID. He started his illegal business in India in 2019 from Bangalore. His parent company was Jianbing Technology in Hangzhou China. He is the director of Omlette technology private limited but indirectly controls or owns companies including IWT India, Ocean trading, Yellow Tune Technologies private limited and Techlite development private limited, stated the police release.

According to EOW officials, there are at least two more Chinese persons who used to assist him in his scam. They used to make his employees or any vulnerable or needy people directors of the

shell companies but actually used to control/ operate the companies and bank accounts. They also used many Call Centres to make abusive/ threatening calls to loanees. It is suspected that they are running such illegal Loan APPs in other countries too especially in Thailand. EOW has already arrested five accused accomplices of the Chinese mastermind.

EOW is in touch with various state police and has conducted raids in Mumbai, Bangalore and Delhi. More than Rs 6.57 Crore has been frozen, said EOW. These fake loan apps once downloaded in one’s mobile play store, small amounts ranging from Rs.3,000 to Rs.10,000 is credited to the customer’s bank account. Once the amount is credited to the customer’s bank account, within a week the customer/borrower is asked to repay the amount with an excessive rate of interest.

In denial to pay the high rate of interest, the concerned customer is humiliated or bullied in many ways. Obscene messages and indecent pictures along with abusive texts in filthy languages are sent to his/her WhatsApp number and as well as to his/her contact list as a coercive measure to recover the loan amount with interest. This process of recovery is so overbearing and humiliating that there are some instances of the customers committing suicide. There has been already more than 1.5 lakh downloads of KOKO and JOJO loan.

EOW has received more than 100 complaints from Odisha related to illegal or abusive activities of illegal Loan APP. (ANI)