New Delhi [India], January 3 (ANI/NewsVoir): An Indian banker with long time expertise on Japan, Rajeev Sinha of Bank of India, has proposed a groundbreaking solution to convert the soft loans from Japan, like the proposed 18 billion USD Mumbai Ahmedabad High-Speed Rail (MAHSR) loan, with Japanese Yen FX risk currently, to extremely low-interest loans in Indian Rupees while mitigating the FX Risk. This proposal, if applied effectively, will greatly further enhance the attractiveness of Japanese loans to India which have been so far frequently attacked by the critiques and media for the FX risk, the sources noted.

As a background in the proposal, Rajeev has referred to the 75 billion USD worth INR-JPY swap existing between the Bank of Japan and Reserve Bank of India, revived and upgraded significantly from previous levels during Prime Minister Modi’s last visit to Japan.

This swap with a macroeconomic perspective, as is natural for central banks in international dealings, is signed for the long-term stability of INR-JPY rates but not considered for specific bilateral projects so far, such as this proposal from Rajeev who has indicated this as a win-win for both the countries.

Though the terms of such swaps are currently considerably shorter than the offered Yen loan for the MAHSR project, Rajeev has highlighted in the proposal the inherent willingness of Japan to repeat, prolong or expand the swaps, or even extend Equity Finance instead of loans, for three reasons.

Firstly, the Bank of Japan is known to intervene in the JPY markets internationally and has similar swap arrangements with other countries too, taking deliberate huge losses on a market value basis for the sake of long-term interests and international relations of Japan.

Secondly, projects in India, especially the MAHSR project, are of very high priority for the Japanese government. Thirdly, in case of the long-term JPY loans to India like that of the MAHSR project (with 50 years term topped with 15 years of non-repayment moratorium), the NPV of the repayments for Japan is very negligible and Japan might as well extend Equity Financing for three good reasons again: (1) better for India’s sovereign balance sheet, (2) a fair upside equity potential for Japan with friendly socio-economic & strategic interests in India and (3) great for bilateral relations facilitating industry-to-industry collaboration avoiding the complexities of International Competitive Bidding (ICB) – which has been a difficulty/draw-back in many Japanese projects in India so far, including in the MAHSR project.

Though Rajeev Sinha declined to talk to media given his official position, his brother Sanjeev Sinha, who is based in Tokyo for 25 years through Goldman Sachs, Mizuho Group, UBS Group, and as Japan CEO of TATA Asset Management and TATA Realty and Infra, could be reached on a call for further comments. Sanjeev Sinha concurred on the feasibility of the proposal based on his various discussions with Japanese policymakers and financial institutions and emphasized the need for consensus-building and financial engineering/policy efforts among the Japanese bureaucracy and policymakers.

Sanjeev added that Japan has very good win-win intentions for India but the siloed structures and meticulous processes of Japan make it difficult to create the optimal arrangements or plans, especially in the Indian context.

Over the decades Sanjeev has been pursuing with many Japanese members of parliament, ministers, and heads of financial institutions, which include Sanjeev’s current/former colleagues from the banking and finance industry in Japan, to accommodate these points in well-intentioned Japanese policies especially for India and many good changes are now being seen like PPP PE funds and funds-of-funds in different domains such as JIC with 35 billion USD in electronics/high-tech field with the CEO being the former boss of Sanjeev from Mizuho, JOIN with 20 billion+ USD in urban and transport domain, NEXI for investment guarantees and credit enhancements along with ever more schemes and flexible structures from the longtime friends of India like JICA (with more than 50 billion USD to India already), JBIC and DBJ, besides Indian allocations from Japan Postal Bank ($2 trillion), Japan Postal Insurance ($1 trillion) and GPIF ($1.5 trillion).

Sanjeev also highlighted the Japanese households with $18 trillion being very bullish on India and INR, which helps in public support in the deliberations for Rajeev’s proposal as well as can also be tapped directly through retail offerings of bonds, mutual funds, REITS, Infra Funds, and other structures, as Sanjeev successfully did raising more than a Billion USD as Japan CEO of TATA Asset Management. Sanjeev shared a detailed example of one of his Indian debt funds with underlying OECD currency denominated debt for regulatory reasons, which he converted to an INR exposure debt fund by using commercial currency swaps, due to INR exposure demand of Japanese investors, highlighting the foundation of the feasibility of Rajeev Sinha’s proposal.

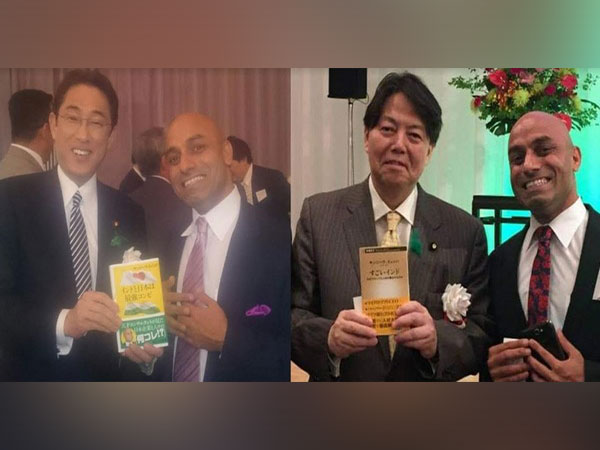

Sanjeev Sinha, an IIT Kanpur graduate, has also been a key facilitator of the MAHSR and Mumbai Trans Harbor Link projects from very early stages as Japan CEO of TATA Asset Management and TATA Realty and Infrastructure and as an advisor to JR. Sanjeev is also highly recognized in Japan for his bilateral efforts as the Founder and President of Pan IIT Alumni Association in Japan facilitating 400 million USD financing plans from Japan for IIT Hyderabad; as an Advisor to Kyoto University facilitating Kyoto and Varanasi sister city collaboration working with Kyoto’s Mayor; as an Advisor to Japan Advanced Institute of Science and Technology (JAIST) facilitating collaboration with IIT Gandhinagar; as Co-founder Marunouchi India Economic Zone (2009) with Mitsubishi Estate which led to first major financing by SoftBank to India (InMobi) in 2011, as Member AI & Diversity Committee on Ministry of Internal Affairs and Communications of Japan promoting senior Indian executives and bureaucrats on Japanese boards for stronger bilateral engagement, Cyber Security and Telecom/Electronics Manufacturing in India involving Japanese financing and Indian Rare Earths; as Chair of AI in Finance Forum and MD of Sony Group’s financial AI division working on holistic integration of financial industry; as the Japan Head of Global Association of Risk Professionals (GARP) working on human resource development in financial-engineering; as a Co-founder of Rockefeller’s Asia Society Japan Center working on geo-political aspects and for his 4 widely read books in Japanese language on India-Japan relations from Japan’s top publishers like Kodansha and NIKKEI with the official promoters including current Japanese Prime Minister Kishida Fumio, Foreign Minister Hayashi Yoshimasa, Speaker of Japanese Parliament Hosoda Hiroyuki, NITI Aayog Vice Chairman Dr. Rajiv Kumar, BSE CEO Ashish Chauhan, Former Minister of Railways Suresh Prabhu, Governor of Japan Bank of International Cooperation (JBIC) and many Ministry of Finance of Japan people who are closely involved in the current JPY policies of Bank of Japan as well as G2G2B funding, among other prominent personalities.

As the proposal from Rajeev Sinha requires certain policy and monetary consensus building on both sides while being in public and economic interests of both India and Japan, the details and the background are released for wider support and discussion on the matter, especially in view of Prime Minister Kishida’s forthcoming India visit, the sources added.

This story is provided by NewsVoir. ANI will not be responsible in any way for the content of this article. (ANI/NewsVoir)