Mumbai (Maharashtra) [India], Apr 27 (ANI): Global steel prices will remain elevated in the first quarter of this fiscal due to higher realisations and new capacities coming on stream before cooling sequentially, according to Crisil.

After a brief lull in February, global steel prices continued to rally and touched 830 dollars per tonne in the last week of March — the highest in the past 12 years.

Low-base effect of the January to March 2020 quarter and small steps towards de-carbonisation that is impacting supply lifted steel prices to 690 dollars per tonne on average in the last quarter of fiscal 2021, compared with 483 dollars per tonne in the same period a year before.

Iron ore supply hiccups at mines in Brazil and Australia also lent lift. However, in January to March 2021, domestic steel prices rose slower than global prices which widened the spread between landed global prices and domestic prices to 19 per cent in March from 2 per cent in October.

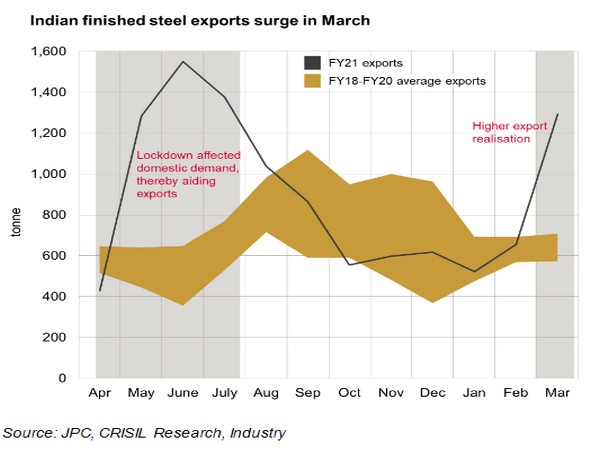

This drove exports up 126 per cent on-year in March to 1,290 kilo tonne (KT) compared with a monthly average of 650 to 750 KT in recent times, said Crisil.

While exports of finished steel in the first quarter of fiscal 2021 were driven by lacklustre domestic demand, the surge in the last quarter was led by higher export realisation. Overall in fiscal 2021, exports increased 29 per cent.

The momentum is expected to continue and push finished steel exports another 12 to 16 per cent higher this fiscal with expectation that incremental supply will exceed incremental demand with the commissioning of six million tonne of new supply.

Interestingly, said Crisil, there were variations in the geography mix of exports last fiscal. In the first half, China accounted for 30 per cent of finished steel exports. In the third quarter, however, that number plunged to a mere 8 per cent with January and February seeing negligible exports.

In contrast, the share of the European Union surged from 13 per cent of exports in the first quarter of last fiscal to over 39 per cent in January to February.

Crisil said domestic prices are expected to remain elevated through the first quarter of the current fiscal with average price hikes of Rs 5,000 per tonne likely sequentially. But from the second quarter, both global and domestic prices will cool sequentially.

For the current fiscal, they are expected to increase 13 to 15 per cent on-year. Supply-tightening reforms in China and the second wave of Covid-19 are key monitorables. (ANI)