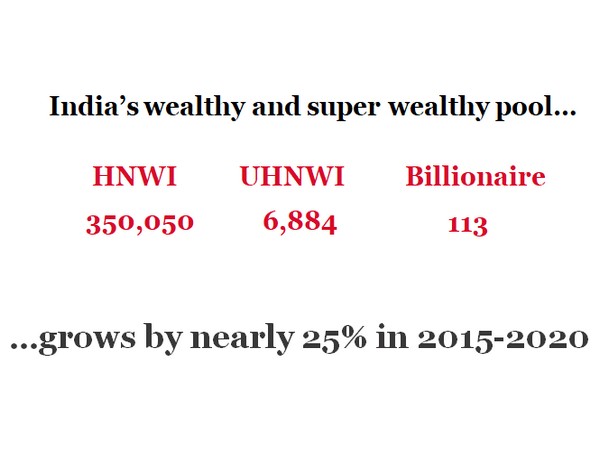

Mumbai (Maharashtra) [India], February 27 (ANI): One out of five of India’s ultra-high-net-worth individuals (UHNWIs) plan to buy a new home in 2021 compared to one out of 10 in 2020, according to Knight Frank’s Wealth Report 2021.

An UHNWI is defined with 30 million dollars (about Rs 217 crore) or more.

The preferred investment locations for ultra-wealthy Indians are largely concentrated in domestic market followed by preferences in international markets of the United States, the United Kingdom, Singapore and the United Arab Emirates.

Globally, about 26 per cent of the ultra-wealthy also plan on purchasing a home in 2021, up against 20 per cent of 2020. The pandemic-induced residential mini-boom is expected to continue through 2021.

Knight Frank estimates this demand to fuel price rises of up to 7 per cent this year for key markets globally.

In terms of attributes while choosing a new home, transport links, internet connectivity and leisure amenities close-by are of prime importance to Indian UHNWIs.

Office and logistics emerged as the top two real estate sectors of interest to UHNWIs for investments in India, while globally it was the residential private rented sector and logistics, which are the top two asset classes of choice.

Indian UHNWIs have 17 per cent of their wealth allocated to property investments compared to 21 per cent globally.

“The pandemic is super-charging demand for locations that offer a surfeit of wellness — mountains, lakes, and coastal hot-spots,” said Liam Bailey, global head of research at Knight Frank.

“Demand is especially strong for rural and coastal properties, with access to open space being the most highly desired feature.” (ANI)